Make a contribution to support a child’s education, get tax exemption

Every financial year, a lot of people have to pay income tax. However, if you take certain steps, you can get rebate on tax.

Here’s your chance to Double Your Impact: Make a contribution to Bal Raksha Bharat to support a child’s education and get tax-exemption under Section 80G.

HOW A CHARITABLE DONATION TO BAL RAKSHA BHARAT CAN HELP YOU SAVE TAX

Education is the best gift you can ever give. Imagine supporting the education of a child and enabling them to build a future – the joy and satisfaction you would receive will be unparalleled. When you donate to support Bal Raksha Bharat’s education projects, you are eligible to avail tax exemption under Section 80G of the Income Tax Act, 1961. Your act of kindness goes a long way in supporting the education of India’s most vulnerable and marginalised children and earns you rewards in the form of tax saving.

As per the Indian Income Tax Department’s rules, a donor is required to add their address and PAN number in case they wish to receive the 80G tax-exemption certificate

Make a contribution to support a child’s education, get tax exemption

Every financial year, a lot of people have to pay income tax. However, if you take certain steps, you can get rebate on tax.

Here’s your chance to Double Your Impact: Make a contribution to Bal Raksha Bharat to support a child’s education and get tax-exemption under Section 80G.

HOW A CHARITABLE DONATION TO BAL RAKSHA BHARAT CAN HELP YOU SAVE TAX

Education is the best gift you can ever give. Imagine supporting the education of a child and enabling them to build a future – the joy and satisfaction you would receive will be unparalleled. When you donate to support Bal Raksha Bharat’s education projects, you are eligible to avail tax exemption under Section 80G of the Income Tax Act, 1961. Your act of kindness goes a long way in supporting the education of India’s most vulnerable and marginalised children and earns you rewards in the form of tax saving.

DONATE TO BAL RAKSHA BHARAT – SAVE TAX AND MAKE A REAL DIFFERENCE

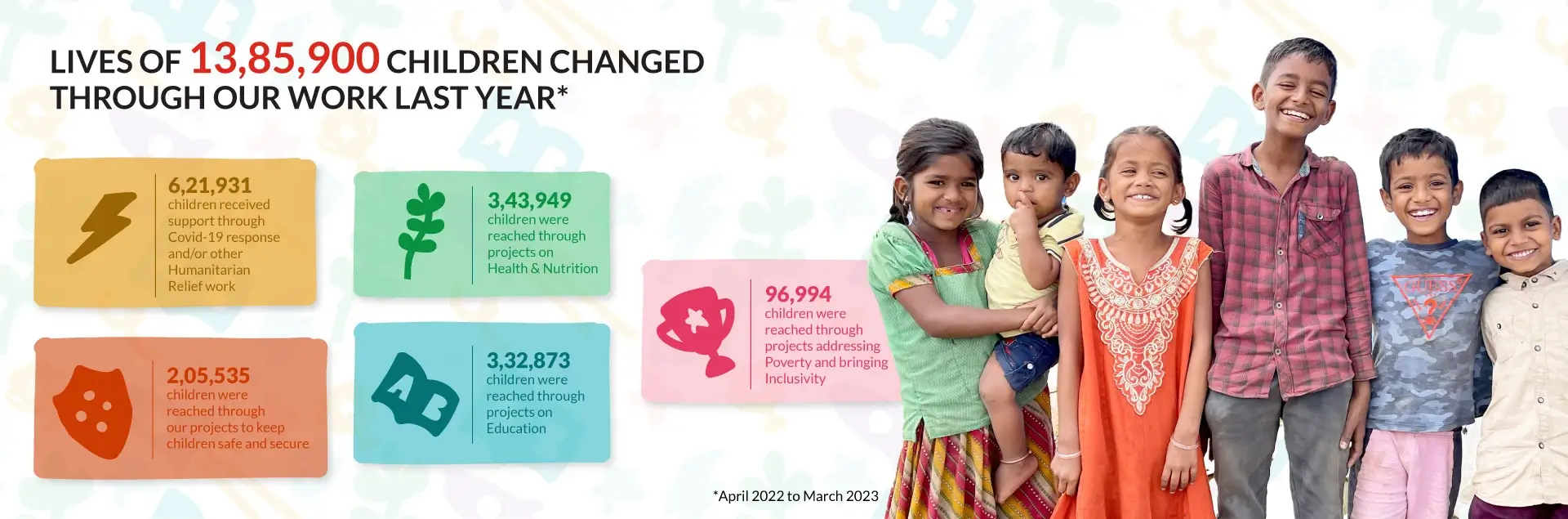

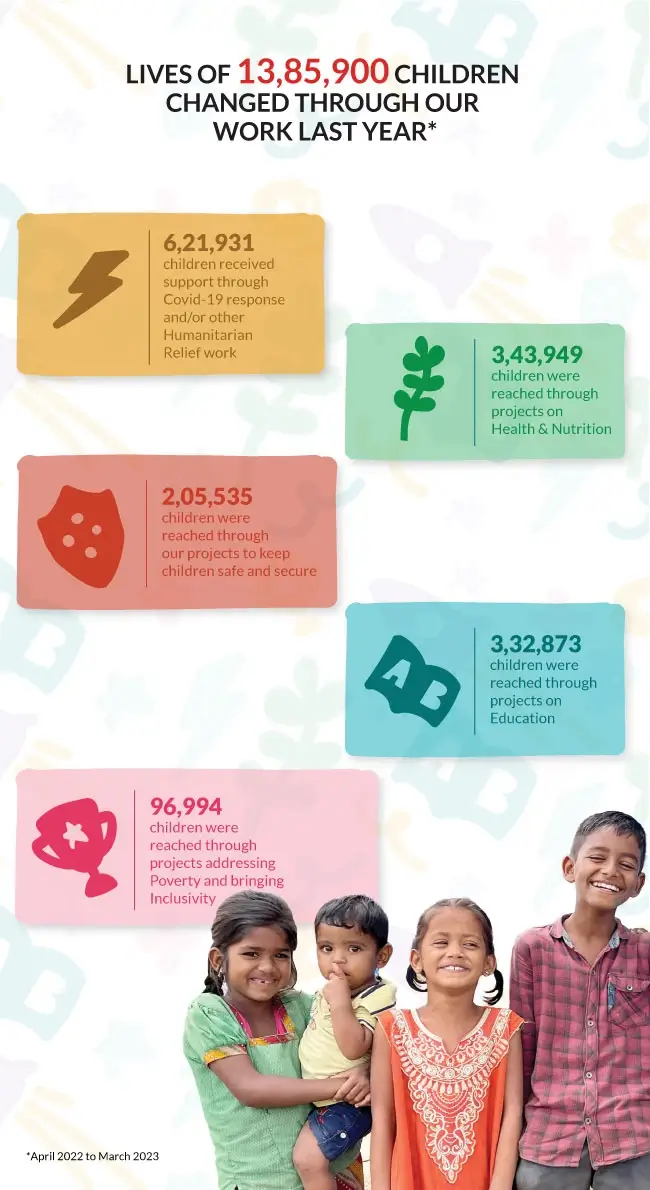

Donating to Bal Raksha Bharat is a true investment in the future of India – its children. We have been working relentlessly since 2004 and have impacted the lives of more than 10 million children. We are committed towards helping the children of India build a Secure Childhood and thus a Secure Future.

Come, make a contribution today to reap dual benefits: the joy and satisfaction of changing a life and the reward of saving tax.

FREQUENTLY ASKED QUESTIONS

-

Is my data safe with you?

-

Bal Raksha Bharat gives tax-exemption under which Section of the Income Tax Act?

-

What is the kind of tax-exemption offered by Bal Raksha Bharat to its donors

-

Will you send me an Income Tax Exemption certificate?

OUR AREAS OF WORK

Education

We work to ensure that the most deprived children come into the fold of education and stay there

Child Protection

We work to keep children out of harm’s way and safeguard them from various forms of abuse, neglect and exploitation

Health & Nutrition

We work to give a healthy start to children along with ensuring better access to healthcare for new mothers and pregnant women

Poverty & Inclusion

We work with an aim to offset the impact of poverty in children’s lives along with providing livelihood support to communities

Resilience

We work to provide life-saving relief to children and their families during disasters and equip them to be better prepared to face emergencies

OUR AREAS OF WORK

Education

We work to ensure that the most deprived children come into the fold of education and stay there

Child Protection

We work to keep children out of harm’s way and safeguard them from various forms of abuse, neglect and exploitation

Health & Nutrition

We work to give a healthy start to children along with ensuring better access to healthcare for new mothers and pregnant women

Poverty & Inclusion

We work with an aim to offset the impact of poverty in children’s lives along with providing livelihood support to communities

Resilience

We work to provide life-saving relief to children and their families during disasters and equip them to be better prepared to face emergencies